Merrill Edge is an online trading platform for beginners and experts best for existing Bank of America customers seeking low-cost trading of multiple assets like stocks, ETFs, and options. Merrill’s robo-advisor, Merrill Guided Investing, is suitable for passive investors, but Merrill Edge doesn’t offer tax loss harvesting. It is a comprehensive low-cost service that works with Bank of America to offer excellent research and resources, exceptional 24/7 customer service, and superior trade quality and price improvement. Advanced traders looking for foreign currency or cryptocurrency investing will need to look elsewhere, however, and there is no fractional share investing and only limited trading of penny and over-the-counter stocks.

About Merrill Edge

Merrill Edge is Bank of America’s investment and advisory program, offering seamless integration with BofA banking services. Hands-on investors can use flexible withdrawals, goal-building investing strategies, and easy transfers with a self-directed Merrill Edge independent brokerage, retirement, or education savings account.

Bank of America’s integration with Merrill Edge gives investors access to global research, market insight, pre-screened lists of investments, and customizable portfolio features for more investment opportunities. You can invest in mutual funds, fixed-income investments, and bonds. Moreover, Commission-free investing with Merrill Edge includes stocks, ETFs, and options trades.

Or you can open a Merrill Guided Investing managed portfolio is a robo-advisor that relies on a mix of computer algorithms and management from a team of financial experts. With a $1,000 ($20,000 with Advisor) minimum investment, you can access a personalized online dashboard, auto-rebalancing features, income-focused retirement portfolios, and custom digital advice.

Merrill does offer one-on-one advising from financial advisors with a Merrill Guided Online with an Advisor account. However, please keep in mind that the initial consultation is complimentary, but you’ll need at least $20,000 in your account to add unlimited online advisor access.

Pros

- Portfolio Story, Dynamic Insights, and the Stock and Fund Stories are the best features for everyday investors since $0 commission stock trades.

- Merrill Edge gives access to high-quality Bank of America Securities proprietary research.

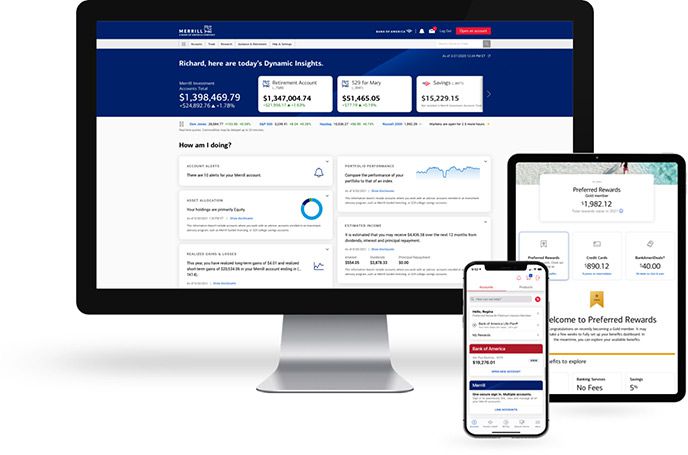

- Clients can view their Merrill Edge account via the Bank of America app, making Bank of America and Merrill Edge a very convenient combination.

- Bank of America’s Preferred Rewards program, which contributed to Merrill Edge’s Best In Class rating for high net worth investors, counts Merrill Edge assets alongside banking assets for reward tiers.

- Merrill has the best user experience for everyday investors out of all the brokers I tested. It has one of the best stock trading apps; both the app and Merrill’s browser platform are attractive, informative, and easy to navigate.

Cons

- We’re well into our second year testing Merrill, and we still haven’t been able to get a direct answer to what their margin rates are. Reps say the rates are based on the overall relationship.

- Merrill, like Fidelity, isn’t super geared toward active traders. Its desktop app, MarketPro, seems better suited for fundamental research than trading, or at least that’s how we prefer using it.

- Merrill Edge doesn’t offer cryptocurrencies, futures, foreign exchange, fractional shares, or paper trading.

- The cost of Merrill’s beautiful design is occasionally long page load times, especially when skimming through Stories.

- Calling Merrill’s customer service about anything other than a routine issue can become an exercise in futility.

Merrill Edge is best for:

Merril Edge has a lot of tricks up its sleeves. It is still an amazing option for everyday investors who are seeking a wealth of research and educational resources. Even existing Bank of America customers will benefit from the integration of their Merrill account with the BoA app. Along with high net worth investors at Merrill Edge can take advantage of Bank of America’s Preferred Rewards program, beginner investors will also find Merrill Edge’s platforms, especially its mobile app, easy to use and navigate. Even options traders will find numerous tools, like OptionsPlay, extremely useful while researching possible trades.

Investment options

Merrill Edge provides ample investment choices and the available services of a megabank. On offer are stocks, ETFs, options, mutual funds, and bonds. Fractional shares, paper trading, futures, forex, and cryptos are not available.

To get the full capabilities of Merrill Edge, plan on e-signing a few documents and seeing a ton of disclosure boilerplate. Other brokers demand less paperwork to accomplish the same tasks. It’s not overwhelming, but it’s noticeable.

Investment guidance

In addition to do-it-yourself investing, Merrill Edge and its corporate parent, Bank of America, offer a full range of investment guidance solutions. For those looking for set-and-forget investing, Merrill offers automated (robo) portfolio management with only a $1,000 minimum.

Limited advisory services with an advisor ($20,000 minimum investment) are also available through its Guided Investing

To conclude…

Merrill Edge is a good choice for everyday investors, especially if you are already a Bank of America customer. It has a full-service and user-friendly platform with access to tons of research, educational resources, and seamless integration with BoA banking. Not for advanced traders or those looking for cryptocurrency and fractional share investing, but robust features, great customer service and the bonus of the Preferred Rewards program make it a good choice for beginners and high net worth individuals. Overall it’s a balanced mix of affordability, research, and convenience making it a good choice for most investors.

(All pictures rights to their respective owners, moreover, The Merrill Edge is an investment company of Bank of America that has a long heritage and has been built over a century. Their name is conjoined with trust and their experience in America’s sector of banking. We would however like to clarify that anything mentioned in this article should NOT be taken as financial advice, and we recommend you to do your own research.

We will not be responsible for any mishaps that happen or any other financial losses you may undergo. Anything you do will be on your own accord, nor do we suggest you do anything, nor do we want any of our words to be interpreted as such. This page doesn’t offer any financial advice and is based off of the opinions of other people. All the statements regarding our History of Merrill Edge are factual information taken from various sources such as Wikipedia and the official website of Merrill Edge.)