Investing in gold has been a trusted method for safeguarding wealth for centuries. But with so many options available today, how do you determine the best approach? This guide breaks down gold investment strategies in simple terms, helping you make informed decisions for a secure financial future.

Introduction to Gold Investment

Gold has been a symbol of wealth and stability for centuries. Whether in the form of coins, bars, or jewelry, it’s more than just a shiny metal it’s a hedge against inflation and economic uncertainty. But how do you start investing in gold? Let’s dive into the various strategies.

Why Invest in Gold?

Gold is like a financial safety net. When stock markets wobble, gold tends to shine. It’s a timeless asset, offering stability during turbulent economic times. Unlike paper money, gold doesn’t lose its intrinsic value. Think of it as a lifeboat in a financial storm.

Understanding Gold’s Value

Gold’s value is influenced by factors like global demand, inflation rates, and geopolitical tensions. Unlike stocks or real estate, gold’s worth isn’t tied to the performance of a single company or location. This makes it an excellent way to diversify your investment portfolio.

Physical Gold: Bars, Coins, and Jewelry

Gold Bars and Coins

Investing in physical gold gives you tangible wealth. Bars and coins, certified for purity, are the go-to options for serious investors. But storage can be tricky—are you ready for a home safe or a bank locker?

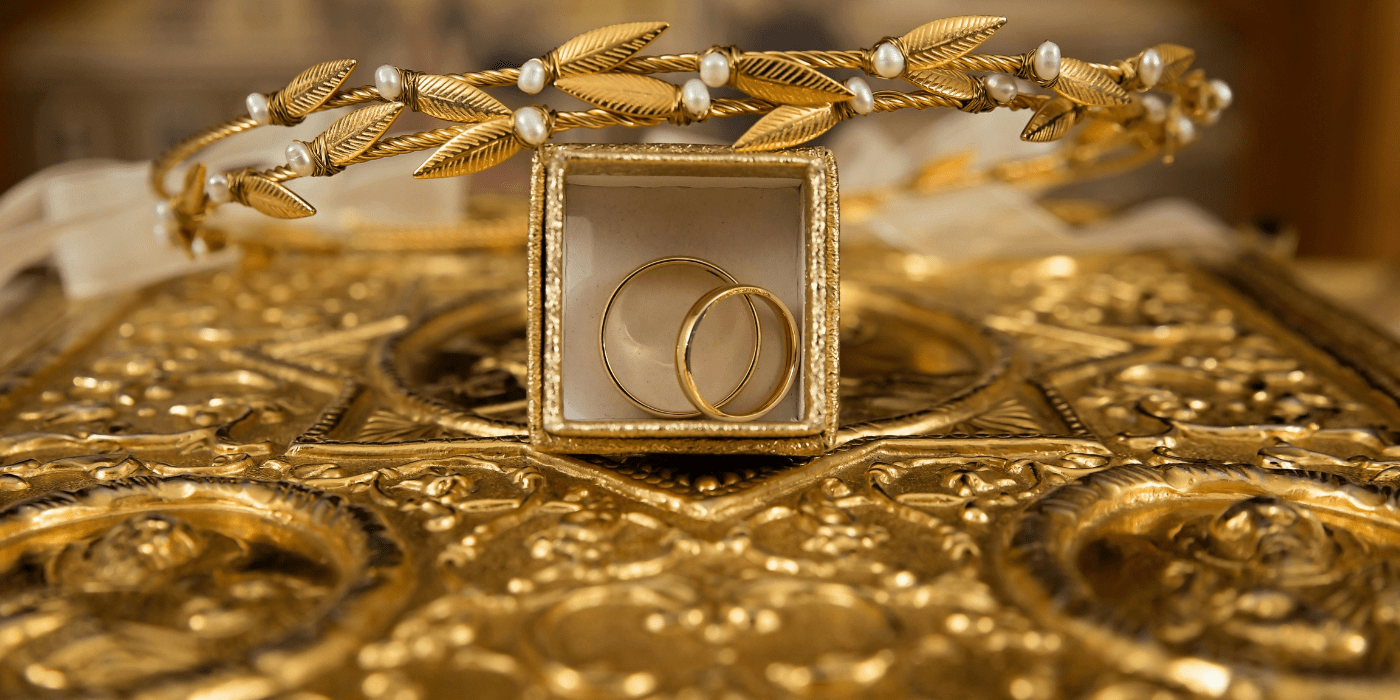

Gold Jewelry

Jewelry holds sentimental and investment value, especially in cultures where it’s exchanged during festivals and weddings. However, remember that craftsmanship charges make it pricier than plain gold.

Gold ETFs and Mutual Funds

What Are Gold ETFs?

Gold Exchange-Traded Funds (ETFs) let you invest in gold without the hassle of physical storage. These funds track gold’s market price, allowing you to buy and sell shares just like stocks.

Benefits of Gold Mutual Funds

Mutual funds that focus on gold-related assets provide a diversified approach. They invest in gold mining companies and bullion, spreading out risk while leveraging gold’s stability.

Gold Futures and Options

For advanced investors, gold futures and options offer opportunities to speculate on price movements. These are contracts that let you buy or sell gold at a set price in the future. While the potential for high returns exists, so do significant risks—think of it as the roller coaster of gold investment.

Allocating Gold in Your Portfolio

Experts recommend allocating 5-10% of your portfolio to gold. This ensures a balanced approach, combining gold’s stability with the growth potential of other assets like stocks or bonds.

Timing the Market: When to Buy Gold?

Gold prices fluctuate based on global events. Historically, prices rise during economic downturns or geopolitical tensions. Keep an eye on the news and market trends to identify the best buying opportunities.

Diversification Through Gold

Gold acts as a counterbalance to volatile investments like stocks. By adding it to your portfolio, you reduce overall risk. It’s like having a mix of sunny days and an umbrella ready for the rainy ones.

Risks of Gold Investment

Market Volatility

Gold prices can be unpredictable in the short term. While it’s a stable asset over time, short-term investments might not yield the expected returns.

Storage and Security

Physical gold requires secure storage. Without proper safeguards, your investment could be at risk.

Liquidity Challenges

Selling physical gold can sometimes be cumbersome, especially when dealing with larger quantities or specific forms.

Tax Implications of Gold Investments

Gold investments are subject to taxes, which vary depending on your location and the form of gold. For instance, selling physical gold might attract capital gains tax, while ETFs could have different rules. Always consult a tax advisor to avoid surprises.

Gold vs. Other Precious Metals

While gold is the most popular choice, other metals like silver and platinum also hold investment value. Silver is more affordable, while platinum’s industrial demand often influences its price. Diversifying across metals can be another strategy.

Building a Long-Term Gold Strategy

Stay Consistent

Gold investment isn’t about quick gains. Consistently buying small amounts over time can help you build wealth gradually.

Set Clear Goals

Are you looking to protect against inflation or grow your wealth? Defining your goals helps tailor your strategy.

Top Tips for New Gold Investors

- Research First: Understand the different ways to invest in gold.

- Start Small: Begin with a manageable amount and grow your investment as you learn.

- Beware of Scams: Only buy gold from trusted sources.

- Stay Informed: Keep an eye on gold prices and market trends.

- Diversify: Don’t put all your eggs in one basket—even a gold one!

Conclusion

Gold investment strategies offer something for everyone, from beginners to seasoned investors. Whether you prefer physical gold, ETFs, or futures, each approach has its unique benefits and risks. By diversifying your portfolio and staying informed, you can make gold a valuable part of your financial journey.